Paul Krugman, everyone's favorite economist, runs kind of a popular blog over at the New York Times. Now, he is constantly ridiculed by libertarians as myself, and another economics blog posting just about this guy is more attention than he really needs. As such, I am writing this post not to call him out, because the guy has as much credibility as a Magic 8-Ball. Rather, I point out the image he posted in his blog to point something out about the way we calculate inflation in this country.

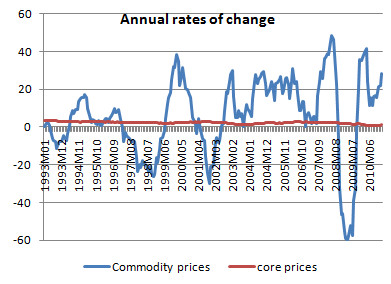

Krugman is constantly on a tirade against Austrian economists, and one of the important claims of Austrians is that higher commodity prices will make their way through various intermediate goods and ultimately result in higher prices for consumer goods. It makes sense theoretically. After all, if it costs more to make something, then it is going to sell for higher or not at all. So Paul Krugman, ever the empirical Aristotle, looks to a graph showing the relationship between commodity prices and core inflation (emphasis on core).

Aha! Paul Krugman finds that there is virtually no relationship between commodity prices and core inflation. Let us put aside the fact that a better representation of this data would be a scatter plot of commodity prices and core inflation 6 months later (because it is ridiculously hard to make out differences in core inflation from that graph). Rather, let us make what I consider to be the more devastating argument.

Directly from the Wikipedia article about core inflation, this economic indicator is defined as a measure of inflation that excludes items with volatile price movements. Well, that sounds interesting. We leave out those goods which do face price swings and only focus on the goods that do not face price swings. I wonder if that will tend to underestimate the price inflation that is going on. This measure also only looks at the goods that people are currently buying. Let's think about that. If the price of something has gone up, do you think that people will begin to buy less of it? So core inflation already has a bias against volatile price movements, and then it does it again!

The use of core inflation, while convenient for progressive economists like Paul Krugman, does not really measure the pain that everyday consumers are going through as a result of higher prices. Higher energy prices hurt us, higher food prices hurt us, so why do we just ignore these when we measure price inflation? My theory is that we only measure this so as to give credence to the bunk economics that the United States elite follows. Meanwhile, in the real world, we have to face the consequences of the poor decisions that they make, and we have these intellectuals in ivory towers trying to persuade us that it is not as bad as we think it is just so that they do not have to face the shame that is acceptance of the fact that their life's work is completely wrong. It is a high price that we all pay for their mistakes.

Tony

ReplyDeleteDo you know the site Shadow Government Statistics. If not it is worth a look. Here is the link

http://www.shadowstats.com/

Yes, I do know that website. And while it still uses a flawed method to measure inflation, at least it shows the true numbers as opposed to the government numbers.

ReplyDelete